Get This Report about Estate Planning Attorney

Get This Report about Estate Planning Attorney

Blog Article

Some Known Facts About Estate Planning Attorney.

Table of ContentsA Biased View of Estate Planning AttorneyEstate Planning Attorney Can Be Fun For EveryoneSome Of Estate Planning AttorneyEstate Planning Attorney Things To Know Before You Buy

Your attorney will also help you make your files official, scheduling witnesses and notary public trademarks as required, so you don't have to stress over trying to do that final step on your very own - Estate Planning Attorney. Last, however not the very least, there is beneficial tranquility of mind in developing a partnership with an estate preparation attorney who can be there for you later onPut simply, estate planning lawyers supply value in many means, much beyond simply providing you with printed wills, trusts, or various other estate preparing records. If you have concerns concerning the process and want to discover more, contact our office today.

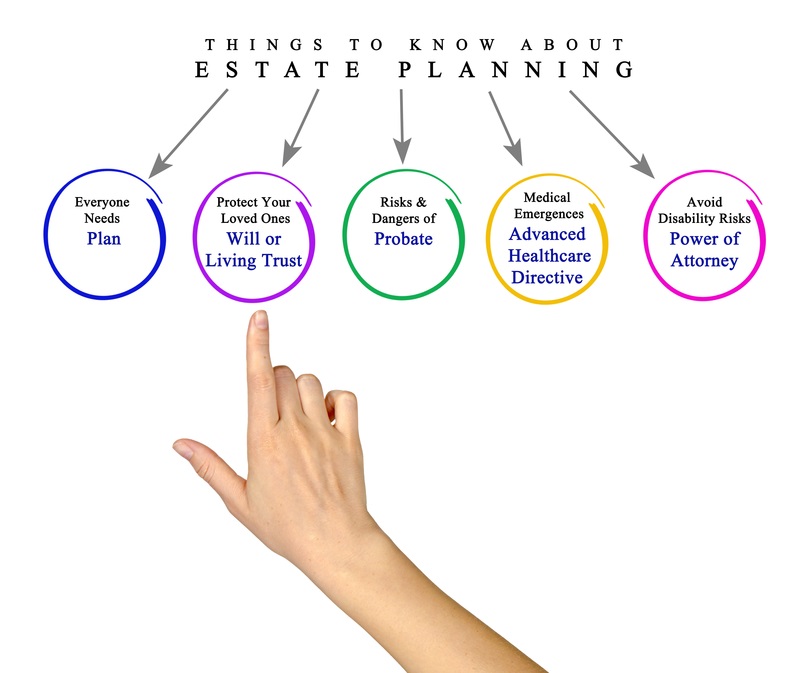

An estate preparation attorney aids you formalize end-of-life choices and lawful records. They can establish wills, develop counts on, create healthcare directives, establish power of lawyer, develop succession strategies, and a lot more, according to your wishes. Dealing with an estate planning attorney to complete and manage this lawful paperwork can aid you in the adhering to 8 locations: Estate preparing lawyers are experts in your state's trust fund, probate, and tax obligation regulations.

If you don't have a will, the state can choose how to separate your assets amongst your heirs, which could not be according to your dreams. An estate preparation lawyer can help organize all your legal records and disperse your properties as you want, potentially avoiding probate.

Getting My Estate Planning Attorney To Work

As soon as a customer passes away, an estate strategy would dictate the dispersal of possessions per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these decisions may be left to the near relative or the state. Duties of estate organizers consist of: Producing a last will and testament Setting up trust fund accounts Calling an executor and power of attorneys Recognizing all recipients Naming a guardian for minor youngsters Paying all debts and decreasing all tax obligations and legal fees Crafting directions for passing your values Establishing choices for funeral setups Settling instructions for care if you come to be ill and are incapable to make decisions Acquiring life insurance policy, handicap earnings insurance coverage, and long-term care insurance coverage A good estate strategy must be updated frequently as customers' monetary circumstances, individual inspirations, and government and state legislations all progress

Just like any kind of occupation, there are features and abilities that can help you accomplish these goals as you deal with your customers in an estate planner role. An estate planning occupation can be right for you if you possess the complying with qualities: Being an estate planner indicates believing in the long term.

The Single Strategy To Use For Estate Planning Attorney

You should help your customer anticipate his or her end of life and what will certainly take place postmortem, while at the very same time not house on dark thoughts or feelings. Some customers might come to be bitter or troubled when contemplating fatality and it can fall to you to aid them check these guys out via it.

In the occasion of death, you may be expected to have countless conversations and transactions with surviving household members about the estate plan. In order to stand out as an estate planner, you might require to walk a fine line of being a shoulder to lean on and the specific depended on to communicate estate preparation issues in a prompt and expert manner.

tax code changed countless times in the one decade in between 2001 and 2012. Anticipate that it has been changed better considering that after that. Relying on your customer's economic income bracket, which may progress towards end-of-life, you as an estate planner will certainly need to keep your client's properties in complete lawful conformity with any neighborhood, federal, or global tax obligation regulations.

The Basic Principles Of Estate Planning Attorney

Acquiring this certification from companies like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. Being their website a participant of these specialist teams can verify your abilities, making you a lot more attractive in the eyes of a potential customer. In enhancement to the emotional incentive of assisting clients with end-of-life preparation, estate coordinators delight in the benefits of a secure earnings.

Estate preparation is an intelligent thing to do no matter your present health and economic condition. Nevertheless, not numerous people recognize where to start the process. The very first vital thing is to work with an estate planning lawyer to aid you with it. The following are 5 benefits of collaborating with an estate preparation attorney.

The percentage of individuals who don't recognize how to get a will has actually increased from 4% to 7.6% because 2017. A seasoned attorney knows what information to consist of in the will, including your beneficiaries and unique considerations. A will shields your family from loss due to immaturity or disqualification. It additionally gives the swiftest and most efficient approach to transfer your assets to your recipients.

Report this page